China's Achilles' Heel

Why the CCP may not be as Powerful as they Appear

Hey Folks,

For much of the last year, I have been covering crime and corruption in Canada.

I took up this task somewhat cynically - I would like to make a living writing, and I know that people like to read about organized crime.

I’m also in a much better position than most people to understand Canada’s underworld, for reasons that I’ll leave to your imagination.

I won’t lie - I was greatly inspired by Whitney Webb’s One Nation Under Blackmail, which explores the deep connections between American organized crime and the state. I thought someone should do the same for Canada.

When it comes to conspiracy theory, Canadians are waaaaaaaaaaay behind our American counterparts. There are a lot of people who are wise to the scam of fractional reserve banking as practiced by the Federal Reserve, but few know the story of how the Bank of International Settlements seized control of the Bank of Canada under Pierre Elliot Trudeau in the 1970s.

Nor do they know that Stephen Harper ceded Canadian sovereignty to China in 2014 when he signed the Foreign Investment Protection Act in Vladivostok, Russia.

And I’m not talking about CBC-swilling smuggles not knowing about this. Even died-in-the-wool Canadian conspiracy theorists don’t know this stuff. Hell, I’ve never even heard James Corbett talk about it!

Nor have I heard “Canadian Patriot” Matthew Ehret mention it. I wonder why.

So I’ve been trying to do my part, but honestly, there’s just way too much to cover. I’m gratified that my work is striking a chord with people, but I’m honestly feeling overwhelmed. There is just way too much crime and corruption in Canada for one person to realistically cover. This is a full time job.

Thankfully, there is at least one professional journalist in Canada who is covering this beat full-time, and I encourage you to subscribe to his Substack.

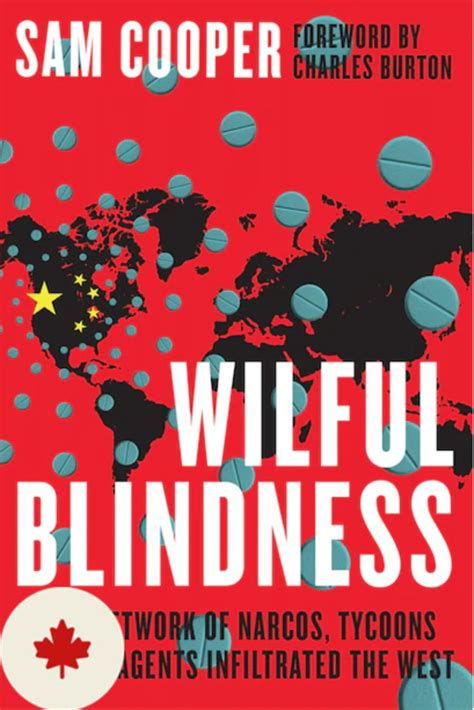

That man is Sam Cooper, Canada’s answer to Clark Kent.

If you’ve been in a coma for the past few years, Sam Cooper is the author of Wilful Blindness, the most important book on Canadian politics to appear in years.

It’s a thick book, but it’s a must-read. No one who hasn’t read it can claim to be up to speed about the current situation in Canada.

Don’t believe me? Watch this video:

Wild, eh? Now do you see why I’ve been writing articles like this?

All this stuff goes back decades, by the way. If you want to do your homework, I recommend checking out a book called Claws of the Panda, which will give you the low-down about Liberal Party powerbroker Michael Chan, who is obviously a Chinese agent.

My conclusion after reading Wilful Blindness is that China’s dominance of Canada is now a fait accompli, but upon more careful reflection, that’s loser talk.

Although China now appears to be supremely powerful, they also have an Achilles’ Heel - corruption. This is a piece of the puzzle that I was previously missing.

Furthermore, China’s economy also may be heading towards its own 2008-style financial crash, and that will significantly weaken its ability to impose its will on other countries.

As far as I can tell, the collapse of the global financial system is a mathematical inevitability at this point, and once that happens, all bets are off.

Although the CCP appears to be a far more formidable force than its Western adversaries, it faces significant challenges of its own. It seems unlikely that China could rule the world either by brute force or by financial clout. It strikes me as more likely that the eventual result of WWIII will be de-globalization, and that suits me just fine!

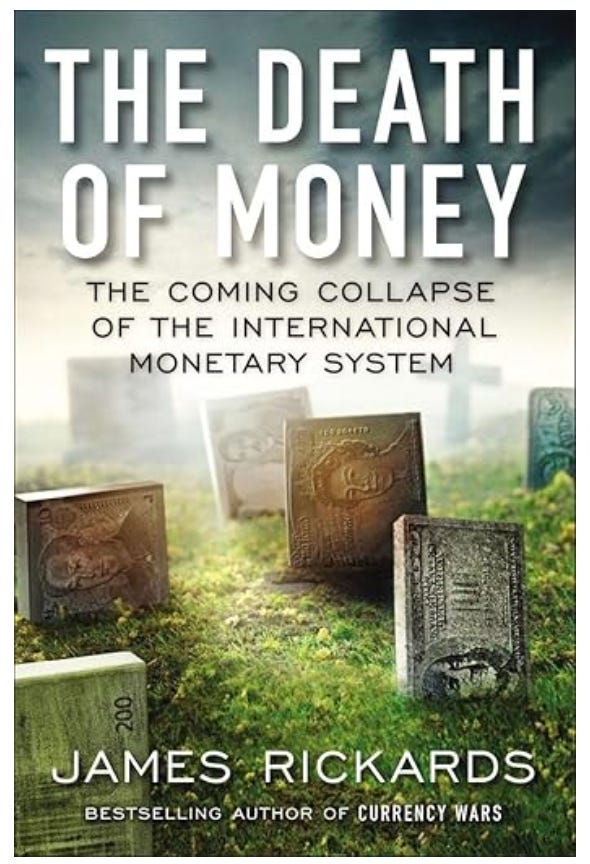

So, today I have decided to share an excerpt from a 2014 book called The Death of Money: The Coming Collapse of the International Monetary System by an economist named James Rickards.

I’ll quickly note two things. First, James Rickards used to work for the C.I.A., so keep that in mind. Second, The Death of Money was written ten years ago, meaning it’s not the most up-to-the-minute report of China’s capabilities. I think it provides an incredible history lesson, though, as well as many insights.

I hope you find this as instructive as I did.

Yours Truly,

Crow Qu’appelle

AUTUMN OF THE FINANCIAL WARLORDS

by James Rickards, excerpted from The Death of Money (2014)

Most countries fail in the reform and adjustment process precisely because the sectors of the economy that have benefitted from distortions are powerful enough to block any attempt to eliminate those distortions.

Michael Pettis

Peking University, December 2012

China’s shadow banking sector has become a potential source of systemic financial risk. To some extent, this is fundamentally a Ponzi scheme.

Xiao Gang

Chairman, Bank of China, October 2012

History's Burden

To contemporary Western eyes, China appears like a monolithic juggernaut poised to dominate East Asia and surpass the West in wealth and output in a matter of years. In fact, China is a fragile construct that could easily descend into chaos, as it has many times before. No one is more aware of this than the Chinese themselves, who understand that China’s future is highly uncertain.

China's is the longest continuous civilization in world history, encompassing twelve major dynasties, scores of minor ones, and hundreds of rulers and regimes. Far from being homogeneous, however, China is composed of countless cultures and ethnicities, comprising a dense, complex network of regions, cities, towns, and villages linked by trade and infrastructure. This has allowed China to avoid the terminal discontinuities that ended other great civilizations, from the Aztec to the Zimbabwe.

A main contributor to the longevity of Chinese civilization is the cyclical nature of governance, consisting of periods of centralization followed by periods of decentralization, then recentralization, and so on, across the millennia. This history is like the action of an accordion that expands and contracts while playing a single song. The tendency to decentralize politically has given Chinese civilization the robustness needed to avoid a complete collapse at the center, characteristic of Rome and the Inca. Conversely, an ability to centralize politically has prevented thousands of local nodes from devolving into an agrarian mosaic, disparate and disconnected. China ebbs and flows but never disappears.

Recognizing the Chinese history of centralization, disintegration, and reemerging order is indispensable to understanding China today. Western financial analysts often approach China with exaggerated confidence in market data, lacking the historical perspective to understand its cultural dynamics. The Zhou Dynasty philosopher Lao Tzu expressed the Chinese sense of history in the Tao Te Ching—“Things grow and grow, but each goes back to its root.” Appreciating that view is no less important today.

The centralized ancient dynasties include the Zhou, from around 1100 B.C.; the Qin, from 221 B.C.; and the Han, which immediately followed the Qin and lasted until A.D. 220. In the middle period of Chinese civilization came the centralized Sui Dynasty in A.D. 581 and the Tang Dynasty, which followed the Sui in A.D. 618. The past millennium has been characterized more by political centralization than disorder, under four great centralized dynasties. These began with Kublai Khan’s legendary Yuan Dynasty in 1271 and continued through the Ming in 1378, the Qing in 1644, and the Communist Dynasty in 1949.

Famous episodes of decentralization and discord include the Warring States period around 350 B.C., when fourteen kingdoms competed for power in an area between the Yangtze and Huang He Rivers. Six hundred years later, in A.D. 220, another decentralized phase began with the Three Kingdoms of Wei, Shu, and Wu, followed by rivalries between the former Qin and the rising Jin Dynasties. Instability was intermittent through the sixth century, with fighting among the Chen, Northern Zhou, Northern Qi, and Western Liang kingdoms, before another unified period began with the Sui Dynasty. A final period of disunity arose around A.D. 923, when eight kingdoms competed for power in eastern and central China.

However, discord was not limited to the long decentralized periods. Even the periods of centralization included disorderly stages that were suppressed or that marked a tumultuous transition from one dynasty to another. Possibly the most dangerous of these episodes was the Taiping Rebellion from 1850 to 1864. The origins of this rebellion, which turned into a civil war, seem incredible today. A candidate for the administrative elite, Hong Xiuquan, repeatedly failed the imperial examination in the late 1830s, ending his chance to join the scholars who made up the elite. He later attributed his failure to a vision that told him he was the younger brother of Jesus. With help from friends and a missionary, he began a campaign to rid China of “devils.” Throughout the 1840s, he attracted more followers and began to exert local autonomy in opposition to the ruling Qing Dynasty.

By 1850, Hong’s local religious sect had emerged as a cohesive military force and began to win notable victories against Qing armies. The Taiping Heavenly Kingdom was declared, with its capital in Nanjing. The Heavenly Kingdom, which exercised authority over more than 100 million Chinese in the south, moved to seize Shanghai in August 1860. The attack on Shanghai was repulsed by Qing armies, now led and advised by European commanders, supplemented with Western troops and arms. By 1864, the rebellion had been crushed, but the cost was great. Scholarly estimates of those killed in the rebellion range from 20 million to 40 million.

A similarly chaotic stage emerged in the so-called Warlord Period of 1916 to 1928, when China was centrally governed in name only. Power was contested by twenty-seven cliques led by warlords, who allied and broke apart in various combinations. Not until Chiang Kai-shek and the National Revolutionary Army finally defeated rival warlords in 1928 was a semblance of unity established. Even then, the Chinese Communist Party, which had been ruthlessly purged by Chiang in 1927, managed to survive in southern enclaves before undertaking the Long March, a strategic retreat from attacking Nationalist forces, finally finding refuge in Shaanxi Province of north-central China.

The most recent period of decentralized political chaos arose in the midst of the Communist Dynasty during the Cultural Revolution of 1966 to 1976. In this chaotic period, Mao Zedong mobilized youth cadres called Red Guards to identify and root out alleged bourgeois and revisionist elements in government, military, academic, and other institutional settings. Millions were killed, tortured, degraded, or forcibly relocated from cities to the countryside. Historic sites were looted, and artifacts smashed in an effort to “destroy the old world and forge the new world,” in the words of one slogan. Only with Mao’s death in 1976, and the arrest of the radical Gang of Four, who briefly seized power after Mao’s death, were the flames of cultural and economic destruction finally extinguished.

Historical memories of these turbulent episodes run deep in the minds of China’s leadership. This explains the brutal suppressions of nations such as Tibet, cultures such as the Uighurs, and spiritual sects such as Falun Gong. The Communist Party does not know when the next Heavenly Kingdom might arise, but they fear its emergence. The slaughter of students and others in Tiananmen Square in 1989 sprang from this same insecurity. A protest that in the West would have been controlled with tear gas and arrests was, to Communist officials, a movement that could have cascaded out of control and therefore justified lethal force to suppress.

David T. C. Lie, a senior princeling, the contemporary offspring of Communist revolutionary heroes, recently said in Shanghai that the current Communist leadership’s greatest fear is not the U.S. military but a volatile convergence of migrant workers and Twitter mobile apps. China has over 200 million migrant workers who live in cities without official permission to do so, and they can be forcibly returned to the countryside on Communist Party orders. China exercises tight control over the Internet, but mobile apps, transmitting through 4G wireless mobile broadband channels, are more difficult to monitor. This combination of rootless workers and uncontrolled broadband is no less dangerous in official eyes than the zeal of a failed mandarin who believed he was the brother of Jesus Christ. This potential for instability is why economic growth is paramount to China’s leadership—growth is the counterweight to emerging dissent.

Prior to 1979, the Chinese economy operated on the “iron rice bowl” principle. The leadership did not promise high growth, jobs, or opportunities; instead, it promised sufficient food and life’s basic necessities. Collective farms, forced labor, and central planning were enough to deliver on these promises, but not much more. Stability was the goal, and growth was an afterthought.

Beginning in 1979, Deng Xiaoping broke the iron rice bowl and replaced it with a growth-driven economy that would not guarantee food and necessities so much as provide people the opportunity to find them on their own. It was not a free market by any means, and there was no relaxation of Communist Party control. Still, it was enough to allow local managers and foreign buyers to utilize both cheap labor and imported know-how to create a comparative advantage in a wide range of tradable manufactured goods.

The China Miracle resulted. Chinese GDP rose from $263 billion in 1979 to $404 billion in 1990, $1.2 trillion in 2000, and over $7.2 trillion in 2011, an astounding twenty-seven-fold increase in just over thirty years. Total Chinese economic output now stands at about half the size of the U.S. economy. This high Chinese growth rate has led to numerous extrapolations and estimates of a date in the not-so-distant future when the Chinese economy will surpass that of the United States in total output. At that point, say the prognosticators, China will resume its role in the first rank of global powers, a position it held in the long-ago days of the Ming Dynasty.

Extrapolation is seldom a good guide to the future, and these predictions may prove premature. Close examination of the economic growth process from a low base shows that such growth is not a miracle at all. If reasonable policies of the kind used in Singapore and Japan had substituted for the chaos of the Cultural Revolution, high growth could have happened decades sooner. Today, the same analytic scrutiny raises doubts about China’s ability to continue to grow at the torrid pace of recent years.

Dynamic processes such as economic growth are subject to abrupt changes, for better or worse, based on the utilization or exhaustion of factors of production. This was pointed out in a classic 1994 article by Princeton professor Paul Krugman called “The Myth of Asia’s Miracle.” This article was widely criticized upon publication for predicting a slowdown in Chinese growth, but it has proved prophetic.

Krugman began with the basic point that growth in any economy is the result of increases in labor force participation and productivity. If an economy has a stagnant labor force operating at a constant level of productivity, it will have constant output but no growth. The main drivers of labor force expansion are demographics and education, while the main drivers of productivity are capital and technology. Without those factor inputs, an economy cannot expand. But when those factor inputs are available in abundance, rapid growth is well within reach.

By 1980, China was poised to absorb a massive influx of domestic labor and foreign capital, with predictably positive results. Such a transition requires training that starts with basic literacy and ultimately includes the development of technical and vocational skills. The fact that China had over half a billion peasants in 1980 did not necessarily mean that those peasants could turn into factory workers overnight. The transition also requires housing and transportation infrastructure. This takes time, but by 1980 the process had begun.

As labor flowed into the cities in the 1980s and 1990s, capital was mobilized to facilitate labor productivity. This capital came from private foreign investment, multilateral institutions such as the World Bank, and China’s domestic savings. Finance capital was quickly converted into plant, equipment, and infrastructure needed to leverage the expanding labor pool.

As Krugman points out, this labor-capital factor input model is a two-edged sword. When the factors are plentiful, growth can be high, but what happens when the factors are in scarce supply? Krugman answers with the obvious conclusion—as labor and capital inputs slow down, growth will do the same. While Krugman’s analysis is well known to scholars and policymakers, it is less known to Wall Street cheerleaders and the media. Those extrapolating high growth far into the future are ignoring the inevitable decline in factor inputs.

For example, five factory workers assembling goods by hand will result in a certain output level. If five peasants then arrive from the countryside and join the existing factory labor force using the same hand-assembly technique, output will double since there are twice as many workers performing the same task. Now assume the factory owner acquires machines that replace hand assembly with automated assembly and trains his workers to use the machines. If each machine doubles output versus hand assembly, and every worker gets one machine, output will double again. In this example, factory output has increased 400 percent, first by doubling the labor force, then by automating the process. As Krugman explains, this is not a “miracle.” It is a straightforward process of expanding labor and productivity.

This process does have limits. Eventually, new workers will stop arriving from the countryside, and even if workers are available, there may be physical or financial constraints on the ability to utilize capital. Once every worker has a machine, additional machines do not increase output if workers can use only one at a time. Economic development is more complex than this example suggests, and many other forces affect the growth path. But the fundamental paradigm, that fewer inputs equals lower growth, is inescapable.

China is now nearing this point. This does not mean growth will cease, merely that it will decelerate to a sustainable level. China has put itself in this position because of its one-child-per-family policy adopted in 1978, enforced until recently with abortion and the murder of millions of girls. That drop in population growth beginning thirty-five years ago is affecting the adult workforce composition today. The results are summarized in a recent report produced by the IMF:

"China is on the eve of a demographic shift that will have profound consequences on its economic and social landscape. Within a few years, the working-age population will reach a historical peak, and will then begin a precipitous decline. The core of this working-age population, those aged 20-39 years, has already begun to shrink. With this, the vast supply of low-cost workers—a core engine of China’s growth model—will dissipate, with potentially far-reaching implications domestically and externally."

Importantly, when labor force participation levels off, technology is the only driver of growth. The United States also faces demographic headwinds due to declining birth rates, but it is still able to expand the labor force 1.5 percent per year, partly through immigration, and it retains the potential to grow even faster through its technological prowess. In contrast, China has not proved adept at inventing new technologies despite its success at stealing existing ones. The twin engines of growth—labor and technology—are both beginning to stall in China.

Still, official statistics show China growing in excess of 7 percent per year, a growth rate that advanced economies can only watch with envy. How can these sky-high growth rates be reconciled with the decline of labor and capital factor inputs that Krugman predicted almost twenty years ago? To answer this, one must consider not only the factor inputs but the composition of growth. As defined by economists, GDP consists of consumption, investment, government spending, and net exports. Growth in any or all of those components contributes to growth in the economy. How does China appear to increase these components when the factor inputs are leveling off? It does so with leverage, debt, and a dose of fraud.

To understand how, consider the composition of China’s GDP compared with those of developed economies such as the United States. In the United States, consumption typically makes up 71 percent of GDP, while in China, the consumption component is 35 percent, less than half that of the United States. Conversely, investment typically makes up 13 percent of U.S. GDP, while in China, investment is an enormous 48 percent of the total. Net exports are about 4 percent of the economy in both the United States and China, except the signs are reversed. China has a trade surplus that adds 4 percent to GDP, while the United States has a trade deficit that subtracts 4 percent from GDP. In concise terms, the U.S. economy is driven by consumption, and the Chinese economy is driven by investment.

Investment can be a healthy way to grow an economy since it has a double payoff. GDP grows when the investment is first made, then grows again from the added productivity that the original investment provides in future years. Still, this kind of investment-led expansion is not automatic. Much depends on the quality of the investment: whether it, in fact, adds to productivity or whether it is wasted—so-called malinvestment. Evidence from recent years is that China’s infrastructure investment involves massive waste. Even worse, this investment has been financed with unpayable debt. This confluence of wasted capital and looming bad debt makes the Chinese economy a bubble about to burst.

The Investment Trap

The recent history of Chinese malinvestment marks a new chapter in the repeated decline of Chinese civilization. This new story revolves around the rise of a Chinese warlord caste—financial, not military in kind—that acts in its own self-interest rather than in China’s interest. These new financial warlords operate through bribery, corruption, and coercion. They are a cancer on the Chinese growth model and the so-called Chinese miracle.

After the 1949 Communist takeover of China, all businesses were owned and operated by the state. This model prevailed for thirty years until Deng Xiaoping’s economic reforms began in 1979. In the decades that followed, state-owned enterprises (SOEs) took one of three paths. Some were closed or merged into larger SOEs to achieve efficiencies. Certain SOEs were privatized and became listed companies, while those remaining as SOEs grew powerful as designated “national champions” in particular sectors.

Among the best-known of these super-SOEs are the China State Shipbuilding Corporation, the China National Petroleum Corporation, the China Petrochemical Corporation (SINOPEC), and China Telecom. There are more than one hundred such giant government-owned corporations in China under centralized state administration. In 2010, the ten most profitable SOEs produced over $50 billion in net profits. The super-SOEs are further organized into sixteen megaprojects intended to advance technology and innovation in China. These megaprojects cover sectors such as broadband wireless, oil and gas exploration, and large aircraft manufacturing.

Regardless of the path taken by state enterprise, corruption and cronyism permeated the process. Managers of SOEs that were privatized received sweetheart deals, including share allocations ahead of the public listing, and executive appointments in the privatized entity. For the enterprises that remained as SOEs, opportunities for corruption were even more direct. Board members and executive officers were political appointees, and the SOEs were protected against foreign and domestic competition. SOEs received cheap financing from government-owned banks and got orders for goods and services from government agencies as well as other SOEs. The result was a dense, complex network of government officials, Communist Party princelings, and private owner-managers, all being enriched by Chinese growth. The elites became a parasite class gorging themselves at the expense of an otherwise healthy and normal growth process.

The rise of a parasitic elite is closely linked to the prevalence of malinvestment. The need for the Chinese economy to rebalance from investment to consumption, as urged by the IMF and other official institutions, has run headlong into the self-interest of the elites who favor infrastructure because it keeps the profits flowing at their steel, aluminum, and other heavy industrial enterprises. The new financial warlords are addicted to the profits of infrastructure, even as economists lament the lack of growth in services and consumption. The fact that this problem is recognized does not mean that it will be managed well. As in all societies, including the United States, elite interests can prevail over national interests once elite political power is entrenched.

Specific examples of infrastructure projects illustrate the waste. Nanjing is one of the largest cities in China, with a population approaching seven million. It is also one of the most historically significant cities, having served as China’s capital under several dynasties as well as the capital of the Taiping Rebellion’s Heavenly Kingdom. More recently, Nanjing was the seat of government, intermittently from 1912 to 1949, during the Chinese Republic of Dr. Sun Yat-sen and later Chiang Kai-shek.

While Nanjing has many of the same problems of pollution and uncontrolled growth as other Chinese cities, it is altogether more pleasant, with abundant parks, museums, and broad, tree-lined boulevards built under imperial influence during the late nineteenth century. Nanjing lies on the Beijing-Shanghai high-speed railway line and is easily reached from both cities. It is among the most important political, economic, and educational hubs in China today.

Immediately south of Nanjing proper lies the Jiangning district, site of one of the most ambitious infrastructure projects now underway in China. Jiangning consists of seven new cities, still under construction, connected by a highway network and an underground metro. Each city has its own cluster of skyscrapers, luxury shopping malls, five-star hotels, man-made lakes, golf courses, recreation centers, and housing and science facilities. The entire metroplex is served by the Nanjing South Railway Station to the north and a newly constructed airport to the south. A visitor cannot help but be impressed with the project’s scale, the quality of the finished phases, and the rapidity with which the entire project is being completed. What struck one as odd on a recent visit is that all of these impressive facilities were empty.

Provincial officials and project managers gladly escort interested parties on a new city tour to explain the possibilities. One laboratory is pointed out as the future source of Chinese wireless broadband technology. Another skyscraper is eagerly described as a future incubator for a Chinese alternative asset management industry. An unfinished hotel is also said to be taking reservations for world-class conferences with A-list speakers from around the world.

Meanwhile, the visitor stares out at miles of mudflats, with poured concrete and steel rebar footings for dozens more malls, skyscrapers, and hotels. This vision of seven new cities would be daunting enough—until one realizes that Nanjing is among dozens of cities all over China building similar metroplexes on a mind-boggling scale. The Chinese have earned a reputation around the world as master builders to rival the Pharaoh Ramesses II.

The Nanjing South Railway Station is not empty, but it also illustrates China’s deficient approach to infrastructure development. In 2009, China was reeling from the same collapse in global demand that had affected the United States after the Panic of 2008. Its policy response was a ¥4 trillion stimulus program, equal to about $600 billion, directed mainly at investment in infrastructure. The United States launched an $800 billion stimulus program at the same time. However, the U.S. economy is more than twice as large as China’s, so on a comparative basis, China’s stimulus was the equivalent of $1.2 trillion applied to the United States. Four years after the program was launched, results are now visible in projects like the Beijing-Shanghai high-speed railroad and the Nanjing South Railway Station.

The station has 4.9 million square feet of floor space and 128 escalators; it generates over 7 megawatts of power from solar panels on the roof. Ticketing and entry to platforms are highly automated and efficient. The new trains are not only fast but also comfortable and quiet, even at their top speed of 305 kilometers per hour. Importantly, the station took two years to build, using a force of 20,000 workers. If the object of such infrastructure is to create short-term jobs rather than transportation profits, the Nanjing South station might be judged a qualified success. The long-term problem is that a high-speed train ticket from Shanghai to Nanjing costs the equivalent of thirty dollars, while a journey of similar length in the United States costs two hundred dollars. The debt incurred by China to build this monumental train station can never be paid with these deeply discounted fares.

Chinese officials rebut the excess capacity criticism by saying that they are building high-quality infrastructure for the long term. They point out that even if it takes five to ten years to fully utilize the capacity, the investment will prove to have been well-founded. But it remains to be seen if such capacity will ever be used.

Apart from the infrastructure’s sheer scale, China’s vision of expanding the science and technology sectors of the economy faces institutional and legal impediments. The high-tech wireless broadband laboratory in Jiangning is a case in point. The research facility has massive buildings with spacious offices, conference rooms, and large labs surrounded by attractive grounds and efficient transportation. Local officials assure visitors that fifteen hundred scientists and support staff will soon arrive, but the most talented technologists require more than nice premises. These scientists will want an entrepreneurial culture, close proximity to cutting-edge university research, and access to the kind of start-up financial mentoring that comes with more than just a checkbook. Whether or not these X-factors can be supplied along with the buildings is an open question. Another problem with building for the long run is that obsolescence and depreciation may overtake the projects while they await utilization.

China’s political leaders are aware that wasted infrastructure spending has permeated the Chinese economy. But like political leaders elsewhere, they are highly constrained in their response. The projects do create jobs, at least in the short run, and no politician wants to preside over a policy that causes job losses, even if it will result in healthier long-run outcomes. Too often in politics, everything is short-term, and the long run is ignored.

Meanwhile, the infrastructure projects are a windfall for the princelings, cronies, and cadres who run the SOEs. The projects require steel, cement, heavy equipment, glass, and copper. The building spree is beneficial to the producers of such materials and equipment, and their interests always favor more construction regardless of costs or benefits. China has no market discipline to slow down these interests or redirect investment in more beneficial ways. Instead, China has an elite oligarchy that insists that its interests be served ahead of the national interest. The political elite’s capacity to stand up to this economic elite is limited because the two are frequently intertwined. Bloomberg News has exposed the interlocking interests of the political and economic elites through cross-ownership, family ties, front companies, and straw man stockholders. Saying no to a greedy businessman is one thing, but denying a son, daughter, or friend is another. China’s dysfunctional system for pursuing infrastructure at all costs is hard-wired.

China can continue its infrastructure binge because it has unused borrowing capacity with which to finance new projects and to paper over losses on the old ones. But there are limits to expansion of this kind, and the Chinese leadership is aware of them.

In the end, "if you build it, they may not come," and a hard landing will follow.

Shadow Finance

Behind this untenable infrastructure boom is an even more precarious banking structure used to finance the overbuilding. Wall Street analysts insist that the Chinese banking system shows few signs of stress and has a sound balance sheet. China’s financial reserves, in excess of $3 trillion, are enormous and provide sufficient resources to bail out the banking system if needed. The problem is that China’s banks are only part of the picture. The other part consists of a shadow banking system of bad assets and hidden liabilities large enough to threaten the stability of China’s banks and cause a financial panic with global repercussions. Yet the opacity of the system is such that not even Chinese banking regulators know how large and how concentrated the risks are. That will make the panic harder to stop once it arrives.

Shadow banking in China has three tributaries: local government obligations, trust products, and wealth management products (WMPs). City and provincial governments in China are not allowed to incur bonded debt in the same fashion as U.S. states and municipalities. However, local Chinese authorities use contingent obligations such as implied guarantees, contractual commitments, and accounts payable to leverage their financial condition. Trust products and wealth management products are two Chinese variants of Western structured finance.

The Chinese people have a high savings rate, driven by rational motives rather than any irrational or cultural traits. The rational motives include the absence of a social safety net, adequate health care, disability insurance, and retirement income. Historically, the Chinese counted on large families and respect for elders to support them in their later years, but the one-child policy has eroded that social pillar, and now aging Chinese couples find that they are on their own. A high savings rate is a sensible response.

But like savers in the West, the Chinese are starved for yield. The low interest rates offered by the banks—a type of financial repression also practiced in the United States—make Chinese savers susceptible to higher-yielding investments. Foreign markets are mostly off-limits because of capital controls, and China’s own stock markets have proved highly volatile, performing poorly in recent years. China’s bond markets remain immature. Instead, Chinese savers have been attracted by two asset classes: real estate and structured products.

The bubble in Chinese property markets, especially apartments and condos, is well known, but not every Chinese saver is positioned to participate in that market. For them, the banking system has devised trust structures and “wealth management products” (WMPs). A WMP is a pool or fund in which investors buy small units. The pool then takes the aggregate proceeds and invests in higher-yielding assets. Not surprisingly, the assets often consist of mortgages, properties, and corporate debt. In the WMP, China has an unregulated version of the worst of Western finance. WMPs resemble the collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), and mortgage-backed securities (MBSs) that nearly destroyed Western capital markets in 2008. They are being sold in China without even the minimal scrutiny required by America’s own incompetent rating agencies and the SEC.

The WMPs are sponsored by banks, but the related assets and liabilities do not appear on the bank balance sheets. This allows the banks to claim they are healthy when, in fact, they are building an inverted pyramid of high-risk debt. Investors are attracted by the higher yields offered in WMPs. They assume that because the WMPs are sponsored and promoted by the banks, the principal must be protected by the banks in the same manner as deposit insurance. But both the high yield and the principal protection are illusory.

The investors’ funds going into the WMPs are being used to finance the same wasted infrastructure and property bubbles that the banks formerly financed before recent credit-tightening measures were put in place. The cash flows from these projects are often too scant to meet the obligations to the WMP investors. The maturities of the WMPs are often short-term, while the projects they invest in are long-term. The resulting asset-liability maturity mismatch would create a potential panic scenario if investors refused to roll over their WMPs when they mature. This is the same dynamic that caused the failures of Bear Stearns and Lehman Brothers in the United States in 2008.

Bank sponsors of WMPs address the problems of nonperforming assets and maturity mismatches by issuing new WMPs. The new WMP proceeds are then used to buy the bad assets of the old WMPs at inflated values so the old WMPs can be redeemed at maturity. This is a Ponzi scheme on a colossal scale. Estimates are that there were twenty thousand WMP programs in existence in 2013 versus seven hundred in 2007. One report on WMP sales in the first half of 2012 estimates that almost $2 trillion of new money was raised.

The undoing of any Ponzi scheme is inevitable, and the Chinese property and infrastructure bubbles fueled by shadow banking are no exception. A collapse could begin with the failure of a particular rollover scheme or with exposure of corruption associated with a particular project. The exact trigger for the debacle is unimportant because it is certain to happen, and once it commences, the catastrophe will be unstoppable without government controls or bailouts. Not long after a crackup begins, investors typically line up to redeem their certificates. Bank sponsors will pay the first ones in line, but as the line grows longer, in classic fashion, the banks will suspend redemptions and leave the majority with worthless paper. Investors will then claim that the banks guaranteed the principal, which the banks will deny. Runs will begin on the banks themselves, and regulators will be forced to close certain banks. Social unrest will emerge, and the Communist Party’s worst nightmare, a replay of the spontaneous Taiping Rebellion or Tiananmen Square demonstrations, will loom.

China’s $3 trillion in reserves are enough to recapitalize the banks and provide for recovery of losses in this scenario. China has additional borrowing power at the sovereign level to deal with a crisis if needed, while China’s credit at the IMF is another source of support. In the end, China has the resources to suppress the dissent and clean up the financial mess if the property Ponzi plays out as described.

But the blow to confidence will be incalculable. Ironically, savings will increase, not decrease, in the wake of a financial collapse because individuals will need to save even more to make up their losses. Stocks will plunge as investors sell liquid assets to offset the impact of now-illiquid WMPs. Consumption will collapse at exactly the moment the world is waiting for Chinese consumers to ride to the rescue of anemic world growth. Deflation will beset China, making the Chinese even more reluctant to allow their currency to strengthen against trading partners, especially the United States. The damage to confidence and growth will not be confined to China but will ripple worldwide.

Autumn of the Financial Warlords

The Chinese elites understand these vulnerabilities and see the chaos coming. This anticipation of financial collapse in China is driving one of the greatest episodes of capital flight in world history. Chinese elites, oligarchs, and even everyday citizens are getting out while the getting is still good.

Chinese law prohibits citizens from taking more than $50,000 per year out of the country. However, the techniques for getting cash out of China, through either legal or illegal means, are limited only by the imagination and creativity of those behind the capital flight. Certain techniques are as direct as stuffing cash in a suitcase before boarding an overseas flight. The Wall Street Journal reported the following episode from 2012:

"In June, a Chinese man touched down at Vancouver airport with around $177,500 in cash—mostly in U.S. and Canadian hundred-dollar bills, stuffed in his wallet, pockets, and hidden under the lining of his suitcase. The Canadian Border Service officer who found the cash said the man told him he was bringing the money in to buy a house or a car. He left the airport with his cash, minus a fine for concealing and not declaring the money."

In another vignette, a Chinese brewery billionaire flew from Shanghai to Sydney, drove an hour into the countryside to see a vineyard, bid $30 million for the property on the spot, and promptly returned to Shanghai as quickly as he had arrived. It is not known if the oligarch preferred wine to beer, but he preferred Australia to China when it came to choosing a safe haven for his wealth.

Other capital flight techniques are more complicated but no less effective. A favorite method is to establish a relationship with a corrupt casino operator in Macao, where a high-rolling Chinese gambler can open a line of credit backed by his bank account. The gambler then proceeds deliberately to lose an enormous amount of money in a glamorous game such as baccarat, played in an ostentatious VIP room. The gambling debt is promptly paid by debiting the gambler’s bank account in China. This transfer is not counted against the annual ceiling on capital exports because it is viewed as payment of a legitimate debt. The “unlucky” gambler later recovers the cash from the corrupt casino operator, minus a commission for the money-laundering service rendered.

Even larger amounts are moved offshore through the mis-invoicing of exports and imports. For example, a Chinese furniture manufacturer can create a shell distribution company in a tax haven jurisdiction such as Panama. Assuming the normal export price of each piece of furniture is $200, the Chinese manufacturer can under-invoice the Panamanian company and charge only $100 for each piece. The Panamanian company can then resell into normal distribution channels for the usual price of $200 per piece. The $100 “profit” per piece resulting from the under-invoicing is then left to accumulate in Panama. With millions of furniture items shipped, the accumulated phony profit in Panama can reach into the hundreds of millions of dollars. This is money that would have ended up in China but for the invoicing scheme.

Capital flight by elites is only part of a much larger story of income inequality between elites and citizens in China. In urban areas, the household income of the top 1 percent is twenty-four times the average of all urban households. Nationwide, the disparity between the top 1 percent and the average household is thirty times. These wide gaps are based on official figures. When hidden income and capital flight are taken into account, the disparities are even greater. The Wall Street Journal reported:

Tackling inequality requires confronting the elites that benefit from the status quo and reining in the corruption that allows officials to pad their pockets. Wang Xialou, deputy director of China’s National Economic Research Foundation, and Wing Thye Woo, a University of California at Davis economist, say that when counting what they call “hidden” income—unreported income that may include the results of graft—the income of the richest 10% of Chinese households was 65 times that of the poorest 10%.

Minxin Pei, a China expert at Claremont McKenna College, states that corruption, cronyism, and income inequality in China today are so stark that social conditions closely resemble those in France just before the French Revolution. The overall financial, social, and political instability is so great as to constitute a threat to the continued rule of China’s Communist Party.

Chinese authorities routinely downplay these threats from malinvestment in infrastructure, asset bubbles, overleverage, corruption, and income inequality. While they acknowledge that these are all significant problems, officials insist that corrective actions are being taken and that the issues are manageable in relation to the overall size and dynamic growth of the Chinese economy. These threats are viewed as growing pains in the birth of a new China, as opposed to an existential crisis in the making.

Given the history of crashes and panics in both developed and emerging markets over the past thirty years, Chinese leaders may be overly sanguine about their ability to avoid a financial disaster. The sheer scale and interconnectedness of SOEs, banks, government, and citizen savers have created a complex system in the critical state, waiting for a spark to start a conflagration. Even if the leadership is correct in saying that these specific problems are manageable in relation to the whole, they must still confront the fact that the entire economy is unhealthy in ways that even the Communist Party cannot easily finesse. The larger issue for China’s leadership is the impossibility of rebalancing the economy from investment to consumption without a sharp decline in growth. This slowdown, in effect the feared hard landing, is an event for which neither the Communists nor the world at large is prepared.

Understanding the challenge of rebalancing requires taking another look at China’s infrastructure addiction. Evidence for overinvestment by China is not limited to anecdotes about colossal train stations and empty cities. The IMF conducted a rigorous analytic study of capital investment by China compared to a large sample of thirty-six developing economies, including fourteen in Asia. It concluded that investment in China is far too high and has come at the expense of household income and consumption, stating, “Investment in China may currently be around 10 percent of GDP higher than suggested by fundamentals.”

There is also no mystery about who is to blame for the dysfunction of overinvestment. The IMF study points directly at the state-controlled banks and SOEs, the corrupt system of crony lending and malinvestment that is visible all over China:

“State-owned enterprises (SOEs) tend to be consistently implicated ...because their implied cost of capital is artificially low. ...China’s banking system continues to be biased toward them in terms of capital allocation.”

State-controlled banks are funneling cheap money to state-owned enterprises that are wasting the money on overcapacity and the construction of ghost cities.

Even more disturbing is the fact that this infrastructure investment is not only wasteful, it is unsustainable. Each dollar of investment in China produces less in economic output than the dollar before, a case of diminishing marginal returns. If China wants to maintain its GDP growth rates in the years ahead, investment will eventually be well in excess of 60 percent of GDP. This trend is not a mere trade-off between consumption and investment. Households deferring consumption to support investment so that they may consume more later is a classic development model. But China’s current investment program is a dysfunctional version of the healthy investment model. The malinvestment in China is a deadweight loss to the economy, so there will be no consumption payoff down the road. China is destroying wealth with this model.

Households bear the cost of this malinvestment, since savers receive a below-market interest rate on their bank deposits so that SOEs can pay a below-market interest rate on their loans. The result is a wealth transfer from households to big business, estimated by the IMF to be 4 percent of GDP, equal to $300 billion per year. This is one reason for the extreme income inequality in China. So the Chinese economy is caught in a feedback loop. Elites insist on further investment, which produces low payoffs, while household income lags due to wealth transfers to those same elites. If GDP were reduced by the amount of malinvestment, the Chinese growth miracle would already be in a state of collapse.

Nevertheless, collapse is coming. Michael Pettis of Peking University has done an interesting piece of arithmetic based on the IMF’s infrastructure research. In the first instance, Pettis disputes the IMF estimate of 10 percent of GDP as the amount of Chinese overinvestment. He points out that the peer group of countries used by the IMF to gauge the correct level of investment may have overinvested themselves, so actual malinvestment by China is greater than 10 percent of GDP. Still, accepting the IMF conclusion that China needs to reduce investment by 10 percent of GDP, he writes:

"Let us... give China five years to bring investment down to 40% of GDP from its current level of 50%. Chinese investment must grow at a much lower rate than GDP for this to happen. How much lower? ... Investment has to grow by roughly 4.5 percentage points or more below the GDP growth rate for this condition to be met."

“If Chinese GDP grows at 7%, in other words, Chinese investment must grow at 2.3%. If China grows at 5%, investment must grow at 0.4%. And if China grows at 3%... investment growth must actually contract by 1.5%.”

The conclusion should be obvious:

“Any meaningful rebalancing in China’s extraordinary rate of overinvestment is only consistent with a very sharp reduction in the growth rate of investment, and perhaps even a contraction in investment growth.”

The suggestion that China needs to rebalance its economy away from investment toward consumption is hardly news; both U.S. and Chinese policymakers have discussed this for years. The implication is that rebalancing means a slowdown in Chinese growth from the 7 percent annual rate it has experienced in recent years. But it may already be too late to accomplish the adjustment smoothly; China’s “rebalancing moment” may have come and gone.

Rebalancing requires a combination of higher household income and a lower savings rate. The resulting disposable income can then go into spending on goods and services. The contributors to higher income include higher interest rates to reward savers and higher wages for workers. But the flip side of higher interest rates and higher wages is lower corporate profits, which negatively impacts the Chinese oligarchs. These oligarchs apply political pressure to keep wages and interest rates low. In the past decade, the share of Chinese GDP attributable to wages has fallen from over 50 percent to 40 percent. This compares to a relatively constant rate in the United States of 55 percent. The consumption situation is even worse than the averages imply, because Chinese wages are skewed to high earners with a lower propensity to spend.

Another force, more powerful than financial warlords, is standing in the way of consumer spending. This drag on growth is demographic. Both younger workers and older retirees have a higher propensity to spend. It is workers in their middle years who maintain the highest savings rate in order to afford additional consumption later in life. The Chinese workforce is now dominated by that mid-career demographic. In effect, China is stuck with a high savings rate until 2030 or later for demographic reasons, independent of policy and the greed of the oligarchs.

Based on these demographics, the ideal moment for China to shift to a consumption-led growth model was the period 2002 to 2005. This was precisely the time when the productive stage of the investment-led model began to run out of steam, and a younger demographic favored higher spending. A combination of higher interest rates to reward savers, a higher exchange rate to encourage imports, and higher wages for factory workers to increase spending might have jump-started consumption and shifted resources away from wasted investment. Instead, oligarchs prevailed to press interest rates, exchange rates, and wages below their optimal levels. A natural demographic boost to consumption was thereby suppressed and squandered.

Even if China were to reverse policy today, which is highly doubtful, it faces an uphill climb because the population, on average, is now at an age that favors savings. No policy can change these demographics in the short run, so China’s weak consumption crisis is now locked in place.

Taking into account the components of GDP, China is seen to be nearing collapse on many fronts. Consumption suffers from low wages and high savings due to demographics. Exports suffer from a stronger Chinese yuan and from external efforts to weaken the dollar and the Japanese yen. Investment suffers from malinvestment and diminishing marginal returns. To the extent that the economy is temporarily propped up by high investment, this is a mirage built on shifting sands of bad debt. The value of much investment in China is as empty as the buildings it produces. Even the beneficiaries of this dysfunction—the financial warlords—are like rats abandoning a sinking ship through the medium of capital flight.

China could respond to these dilemmas by raising interest rates and wages to boost household income, but these policies, while helping the people, would bankrupt many SOEs, and the financial warlords would steadfastly oppose them. The only other efficacious solution would be large-scale privatization, designed to unleash entrepreneurial energy and creativity. But this solution would be opposed not only by the warlords but by the Communist Party itself. Opposition to privatization is where the self-interest of the warlords and the Communists’ survival instincts converge.

Four percent growth may be the best that China can hope for going forward, and if the financial warlords have their way, the results will be much worse. Continued subsidies for malinvestment and wage suppression will exacerbate the twin crises of bad debt and income inequality, possibly igniting a financial panic leading to social unrest, even revolution. China’s reserves may not be enough to douse the flames of financial panic, since most of those reserves are in dollars and the Fed is determined to devalue the dollar through inflation. China’s reserves are being hollowed out by the Fed even as its economy is being hollowed out by the warlords. It is unclear if the Chinese growth miracle will end with a bang or with a whimper, but it will end nonetheless.

China is not the first civilization to ignore its own history. Centralization engenders complexity, and a densely connected web of reciprocal adaptations is the essence of complex systems. A small failure in any part quickly propagates through the whole, and there are no firebreaks or high peaks to stop the conflagration. While the Communist Party views centralization as a source of strength, it is the most pernicious form of weakness because it blinds one to the coming collapse.

China has fallen prey to the new financial warlords, who loot savings with one hand and send the loot abroad with the other. The China growth story is not over, but it is heading for a fall. Worse yet, the ramifications will not be confined to China but will ripple around the world. This will come at a time when growth in the United States, Japan, and Europe is already anemic or in decline. As in the 1930s, the depression will go global, and there will be nowhere to hide.

Crow,

The historical part of the Rickards excerpt was *interesting*, but I have to say that I don't trust this guy one bit.

Once I *accidentally* got on his mailing list and he was impossible to get rid of. My suspicion is that he is running a scam.

https://www.bogleheads.org/forum/viewtopic.php?t=162432

"He seems mostly to stoke and then prey on people's fears, likely to his financial advantage," says one commenter, and that is exactly my impression of what he is about.

As a Chinese youth, I really appreciate your analysis of the situation. We are waiting for wars.